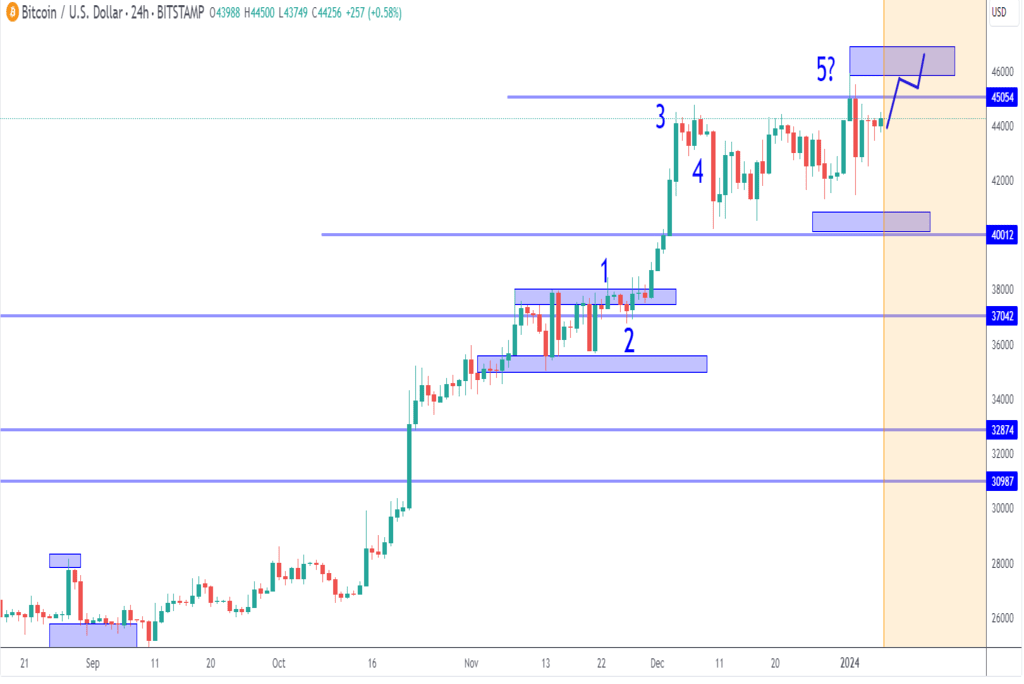

Bitcoin: One More Try 50K?

In the analysis of market trends, recognizing the trend structure is crucial. The current trend shows a higher low at 40K, indicating a bullish pattern as long as this holds. This suggests a higher likelihood of successful long signals and setups, while shorts are considered counter-trend, riskier, and less probable.

The scenario involves Wave 4, which could extend into a compound corrective structure. This leaves room for a potential bullish Wave 5, possibly reaching the 46 to 50K area. However, this outcome could be influenced by unexpected catalysts.

In terms of probability within the 40 to 46K range, the 40 to 42K zone is seen as a high probability area for a bullish reversal, making it prime for new long setups. The 42 to 44K range is unpredictable, while 44 to 46K is considered a high probability zone for a bearish reversal, suitable for exiting long positions or aggressive shorts, which carry higher risk.

It’s important to remember that the bullish scenario can change quickly with unforeseen news, impacting market sentiment. Many investors currently in long positions might add to selling pressure if bearish surprises occur.

A key skill in market analysis is extracting actionable insights from common information and using it to adjust expectations. This approach helps in anticipating market movements, contrasting with a reactive strategy that responds to market changes as they happen.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Chainlink

Chainlink  Aptos

Aptos  Arbitrum

Arbitrum  Injective

Injective  Polygon

Polygon