Bitcoin rally surpasses $52K, hitting $1T market cap, amid greed index spike; investors eye $64K amidst volatility and optimism. Is a downshift imminent ?

In an impressive show of strength, Bitcoin (BTC) has once again captured the attention of the financial world by surging past the $52,000 mark during Wednesday’s trading session. This rally not only pushed Bitcoin’s market capitalization back over the elusive $1 trillion threshold for the first time since December 2021 but also marked a significant recovery from a brief dip below $50,000. Triggered by hotter-than-expected U.S. inflation data, this dip was short-lived, with Bitcoin quickly reclaiming its position above the psychologically significant price level during European trading hours.

Historically, Bitcoin has seen only 145 daily closes above $50,000, highlighting the rarity and significance of its current price level, as reported by CoinDesk’s Bitcoin Price Index (XBX). Wednesday’s rally was marked by a 4.7% increase in the broad-market CoinDesk20 Index (CD20), with altcoins like Cardano’s ADA and the meme token Dogecoin (DOGE) also posting gains around 6%. Ethereum (ETH) wasn’t left behind, soaring over 5% to reach $2,750, its highest price since May 2022.

Amid this broad-market rise, bullish sentiment around Bitcoin continues to mount, with options traders setting their sights as high as $75,000 in the coming months. A particular focus for some traders is the $64,000 level, buoyed by growing demand for spot bitcoin exchange-traded fund (ETF) products. U.S.-listed spot Bitcoin ETFs, such as BlackRock’s IBIT, have seen strong inflows, with nearly $500 million in net inflows reported on Tuesday. This positive sentiment is slightly tempered by potential redemptions, as crypto lender Genesis received bankruptcy court approval to sell its GBTC holdings worth $1.3 billion.

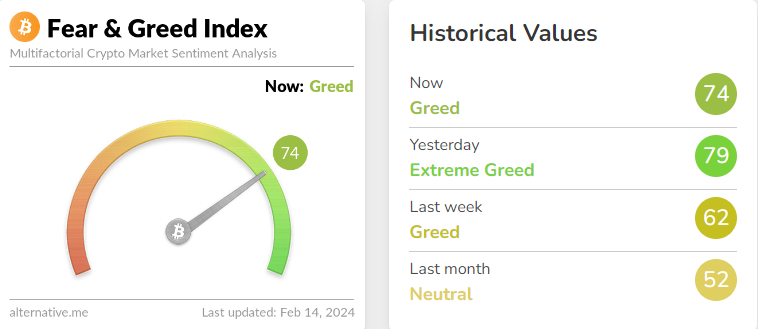

However, a key factor adding to the market’s dynamics is the current Bitcoin Fear and Greed Index, which stands at 74, indicating a sentiment of greed. This metric suggests that the market is currently leaning towards excessive optimism, which historically has been a precursor to volatility or corrections. The index, by reflecting the emotional state of the market, warns investors of potential shifts, indicating that while the bullish trend may continue, caution is advised.

Swissblock analysts have noted that while Bitcoin may continue its uptrend, key support levels, such as $46,000, must hold to maintain momentum. They also caution against the slowing momentum, suggesting that while the market’s outlook remains positive, investors should be mindful of potential shifts.

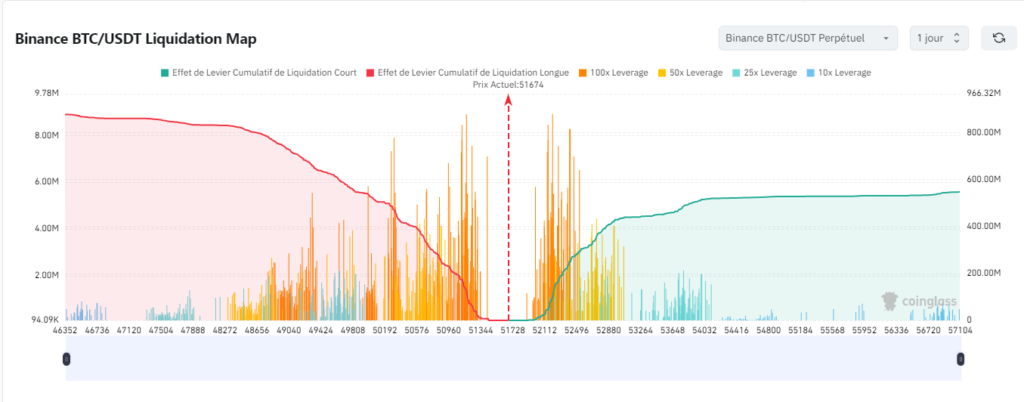

The implications of a high greed index are manifold. Historically, periods of high greed have often been followed by market corrections as investors take profits and reassess their positions. This is not to say that a downturn is imminent, but rather that the market may be more susceptible to news and events that could trigger a sell-off. Investors are advised to balance their optimism with a healthy dose of caution, considering both the market’s momentum and the underlying risks. Bitcoin short liquidation are concetrated on the 54K level, the price could drop to 48K level to liquidate longs.

As Bitcoin continues its rally, the market’s eyes are fixed on the $64,000 target, with the backdrop of a high greed index adding a layer of complexity to the investment plan. The coming weeks will be crucial in determining whether Bitcoin can sustain its momentum or if the market’s greed will lead to a recalibration of expectations.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Chainlink

Chainlink  Aptos

Aptos  Arbitrum

Arbitrum  Injective

Injective  Polygon

Polygon