Current market trends suggest a potential Altcoin season, with mixed performance against Bitcoin signaling a cautious yet optimistic investor sentiment.

Altcoin Performance

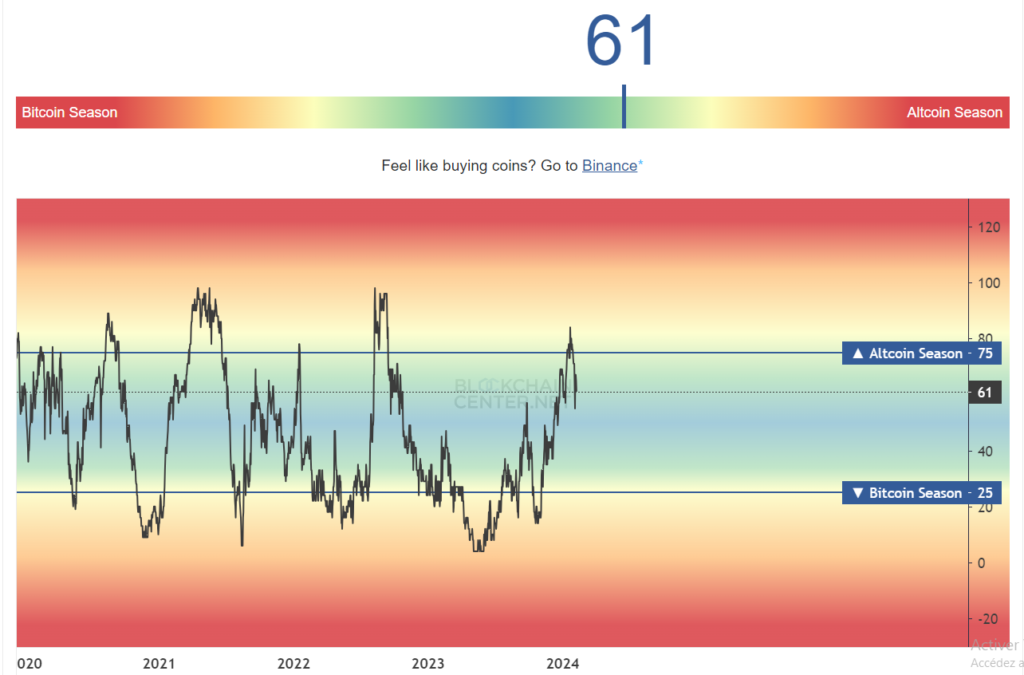

As the cryptocurrency market continues to evolve, the distinction between Bitcoin season and Altcoin season becomes a focal point for investors and enthusiasts alike. The concept is straightforward: when 75% of the top 50 coins outperform Bitcoin over a 90-day period, excluding stablecoins and asset-backed tokens, it signals the start of an Altcoin season. This period is characterized by a surge in investor interest and market capitalization in cryptocurrencies other than Bitcoin.

At present, the market is buzzing with anticipation, but Altcoin season has not yet fully arrived. This is evident from the latest data suggesting that the top 50 coins, albeit performing impressively, have not collectively surpassed the Bitcoin benchmark to declare a full-blown Altcoin season. The intricate dance between Bitcoin and Altcoins continues, with each taking turns leading the crypto waltz.

Understanding Market Indicators

The indicators used to assess whether it is Bitcoin or Altcoin season are not arbitrary but based on meticulous market analysis. The “Altcoin Season Index” is one such tool, which measures the performance of Altcoins against Bitcoin. A value above 75 on this index typically indicates Altcoin season, while a value below 25 suggests a Bitcoin season. Currently, the index shows a score of 61, sitting in a neutral zone, indicating a mixed market sentiment where neither Bitcoins nor Altcoins have complete dominance.

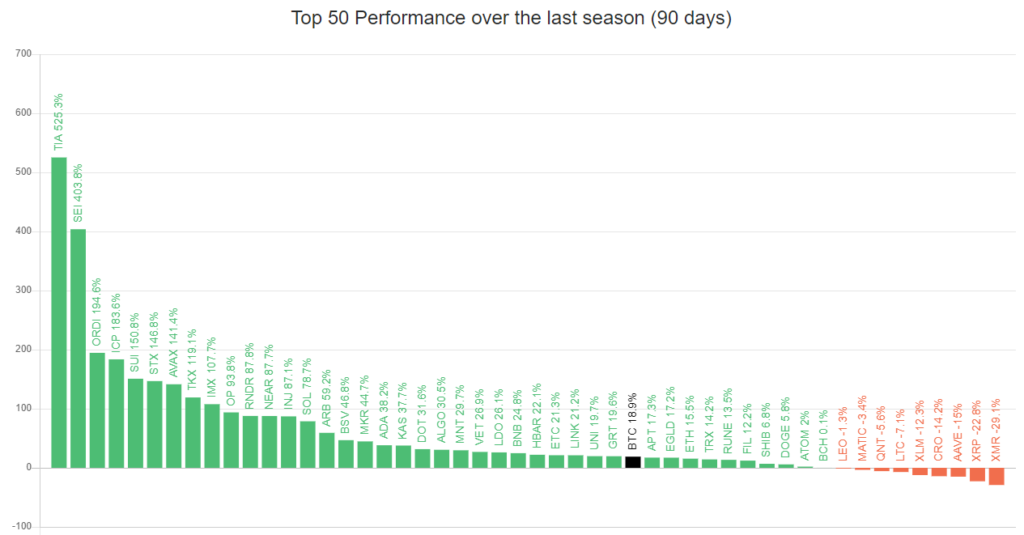

Performance Analysis of the Top 50 Cryptocurrencies

A closer look at the performance chart of the top 50 cryptocurrencies reveals a diverse picture. Some Altcoins have posted staggering gains, with a few even exceeding 600% returns over the last 90 days. This impressive performance is contrasted by others that show more modest gains, and a handful have dipped into the red zone. The distribution of these performances is critical in determining the market’s direction and whether Altcoins as a group can tip the scales to officially declare their season.

The Interplay of Market Forces

The dynamics of Altcoin and Bitcoin seasons are influenced by a myriad of factors, including investor sentiment, technological advancements, regulatory news, and market liquidity. Bitcoin, often regarded as the digital gold, is seen as a safe haven during turbulent market conditions. In contrast, Altcoins are perceived as more speculative investments, offering higher risk but potentially higher rewards.

During periods when investors are feeling bullish, Altcoins can experience a surge in both price and popularity, as traders seek to capitalize on the volatility and potential for substantial returns. Conversely, in times of market uncertainty or bearish sentiment, Bitcoin may regain its dominance as investors seek the relative stability it provides.

Implications for Investors

For investors, the key to capitalizing on the fluctuating market is timing and diversification. While Altcoin season can present lucrative opportunities, it also comes with increased risk. Astute investors keep a close watch on market trends, regulatory changes, and technological developments to make informed decisions.

The anticipation of Altcoin season creates a palpable excitement in the crypto community. It is a time when new projects can gain traction, and lesser-known coins can experience explosive growth. However, the current state of the market requires patience and a keen eye for the shift in momentum that will herald the arrival of a full Altcoin season.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Chainlink

Chainlink  Aptos

Aptos  Arbitrum

Arbitrum  Injective

Injective  Polygon

Polygon