Is Crypto Price Manipulated ? How Can You Stay Safe

To face cryptocurrency price manipulation effectively, investors should adopt a strategy focusing on education, due diligence, and risk management.

To address concerns about cryptocurrency price manipulation and ensure safety while navigating the crypto market, it’s crucial to understand the landscape and adopt a well-informed approach. Cryptocurrency markets, with their relatively nascent and decentralized nature, can be susceptible to certain manipulative practices that could affect prices. Here’s a comprehensive guide to understanding this issue and safeguarding your investments.

Understanding the Landscape

Cryptocurrency price manipulation can manifest in various forms, including but not limited to, pump and dump schemes, wash trading, and spoofing. These tactics exploit the market’s liquidity, anonymity, and regulatory gaps, potentially leading to artificial price inflation or deflation. For instance, pump and dump schemes involve artificially inflating the price of a cryptocurrency before selling it off at its peak, while wash trading refers to creating misleading market activity by simultaneously buying and selling the same cryptocurrencies.

The Impact for investors or traders

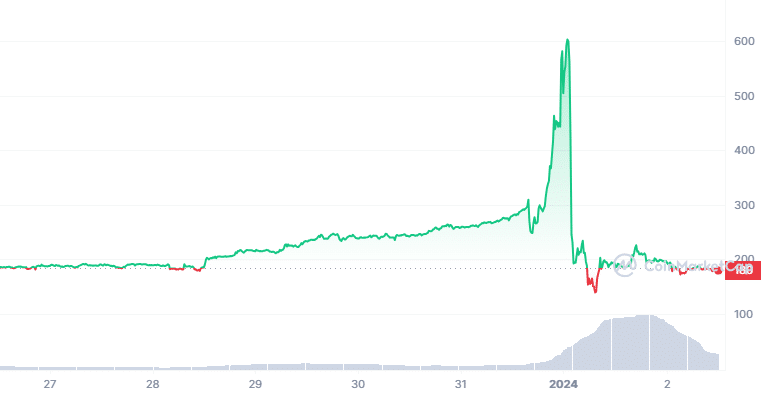

Such manipulative practices can have profound implications for investors, particularly those new to the crypto space. They can lead to significant financial losses, undermine market integrity, and erode trust in the cryptocurrency ecosystem. Consequently, understanding these risks and how to mitigate them is essential for anyone looking to invest in cryptocurrencies. Here is a recent exemple of Tellor (TRB) Altcoin.

This massive pump and dump has sparked allegations of manipulation and insider trading. Just as the price spiked to its peak, Etherscan data showed a transaction of 4,211 Tellor (TRB) tokens worth approximately $2.4 million being moved from the Tellor team to a Coinbase wallet. The timing of this large transfer to an exchange has raised suspicions. Whale Wallets Accused of Orchestrating Altcoin Tellor’s Parabolic Surge

Strategies for Safety:

Educate Yourself

The first step towards protecting your investments is education. Understanding the basics of how the cryptocurrency market operates, including its vulnerabilities to manipulation, is crucial. This knowledge can help you recognize potential red flags and make informed decisions.

Choose Reputable Platforms

Opt for well-established and regulated exchanges for trading and investing in cryptocurrencies. These platforms are more likely to implement robust security measures and adhere to regulatory standards, offering a level of protection against manipulation. Most secure platforms by far are Binance, Kucoin, and coinbase.

Diversification

Diversifying your investment portfolio can help mitigate the risks associated with market manipulation. By spreading your investments across different assets, you reduce the impact of volatility on your overall portfolio.

Conduct Thorough Research

Before investing in any cryptocurrency, conduct detailed research. Examine the project’s fundamentals, including its technology, use case, team, and community support. Legitimate projects with transparent operations and active communities are generally less susceptible to manipulation.

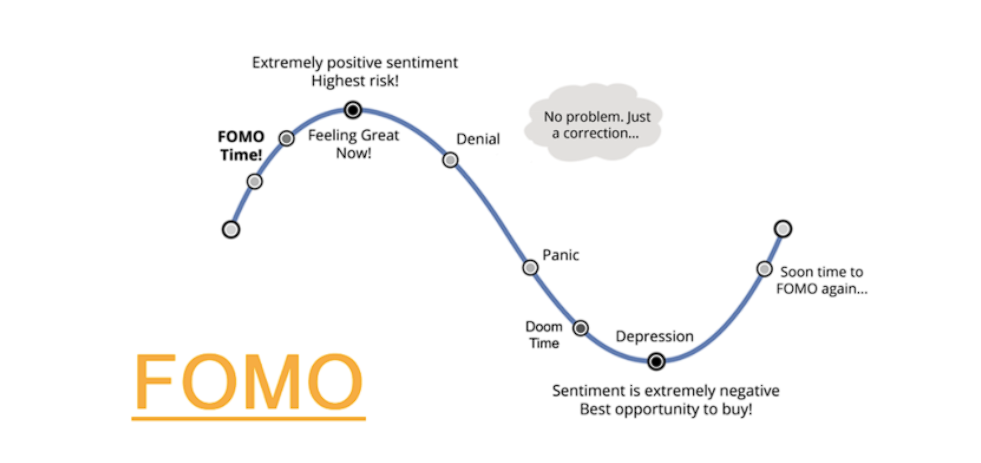

Beware of FOMO

The fear of missing out (FOMO) can lead investors to make hasty and ill-informed decisions, often based on hype or manipulated information. Approach each investment opportunity with caution and due diligence.

Secure Your Investments

For long-term holdings, consider using cold storage solutions to keep your cryptocurrencies offline and secure from online threats, including hacking and manipulation.

Stay Informed

The cryptocurrency market is dynamic, with regulatory and technological developments continually shaping the landscape. Keeping abreast of these changes can help you adapt your strategies and make more informed investment decisions.

Conclusion

While the potential for price manipulation in the cryptocurrency market exists, understanding the risks and adopting a cautious and informed approach can significantly enhance your investment safety. By employing the strategies outlined above, investors can navigate the crypto space more confidently and securely, contributing to a more stable and trustworthy ecosystem.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  Cardano

Cardano  Avalanche

Avalanche  TRON

TRON  Shiba Inu

Shiba Inu  Chainlink

Chainlink  Aptos

Aptos  Arbitrum

Arbitrum  Injective

Injective  Polygon

Polygon