Following the founder’s announcement, Uniswap’s increased fees could diminish its appeal as a favored, private DEX choice.

The Announcement and Its Implications

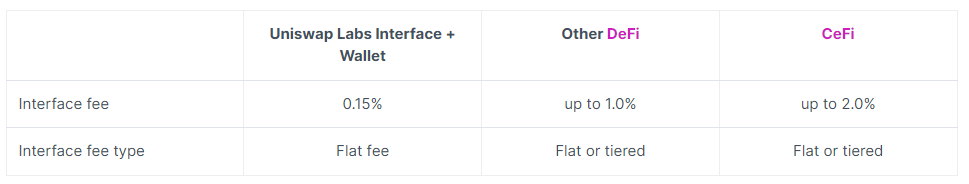

According to a post on platform X by Uniswap’s founder Haydenz Adams, starting today, certain transactions on Uniswap’s web interface will incur additional fees of 0.15%. This fee applies to eleven specific tokens, including:

- ETH

- USDC

- WETH

- USDT

- DAI

- WBTC

- agEUR

- GUSD

- LUSD

- EUROC

- XSGD

Importantly, these additional fees are only applicable to transactions involving the exchange of tokens for fiat currency, meaning they affect only entry or exit transfers. This move means customers will now pay more on top of the usual governance and pool fees charged during transactions. With this new fee structure, Uniswap aims to collect around one million dollars per day, funds which are intended to support the ongoing development of the platform and the introduction of new services.

A Mixed Reception

While Uniswap’s management may view these new fees as an opportunity for growth and development, the reception from the public has been less than enthusiastic. This sentiment is mirrored in the performance of Uniswap’s native token, which saw a 3% decline overnight following the announcement. Investors and users alike have criticized the decision as penalizing to the user base, expressing concerns that it further demonstrates a lack of prioritization of the UNI token by the platform’s leadership. Many are voicing frustrations over the absence of measures to boost the token’s value, especially given its disappointing performance.

The Broader Context

This development comes at a time when the cryptocurrency market is increasingly scrutinizing the practices of exchange platforms, whether centralized or decentralized. Users are becoming more vigilant about fees, transparency, and the overall integrity of the platforms they choose to invest in. Uniswap’s decision to introduce additional fees, therefore, raises questions about the future of DEX platforms and their ability to remain competitive and appealing to a broad user base.

Conclusion

The introduction of new fees by Uniswap marks a significant shift in its operating model, one that may have far-reaching implications for its community and the DEX market as a whole.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Chainlink

Chainlink  Aptos

Aptos  Arbitrum

Arbitrum  Injective

Injective  Polygon

Polygon